Strategy

The strategy is based on active risk management, where the risk level is adjusted depending on market opportunities. The strategy is expected to create a stable return with small drawdowns and low correlation to other asset classes.

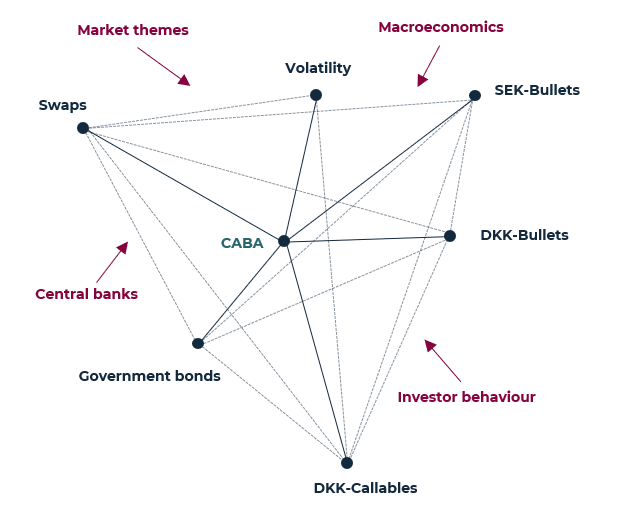

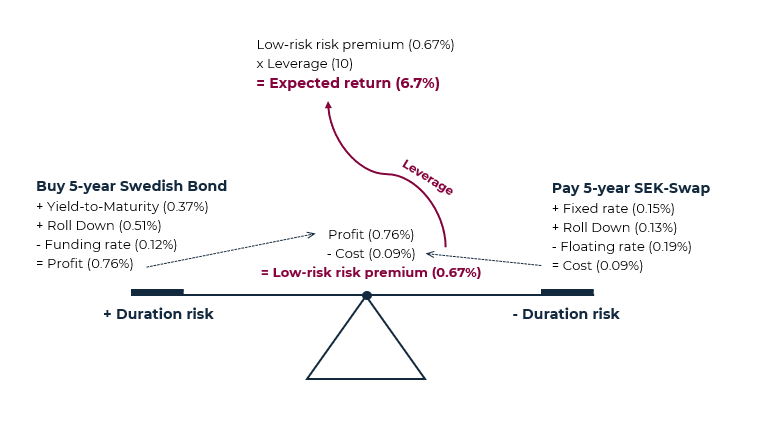

The investments are made within the Scandinavian bond universe and is based on relative-value analyses. This approach implies that all parts of the investment universe is analysed against each other, including the interest rate differentials between mortgage and government bonds as well as the interest rate differentials between different types of mortgage bonds. All for the purpose of identifying the trades that are expected to provide the best possible return, considering the risk and in the context of current events, macroeconomic prospects, the actions of central banks and the behaviour of other investors. By trades is meant either trades where an attractive carry is obtained or trades that potentially can generate returns in certain market scenarios.

This creates an attractive return/risk-profile that does not follow other asset classes. CABA Hedge is a liquid alternative investment.