Copenhagen, June 15 - 2021

Powell might be missing the point: “Shadow Base Effects”!

Kristian Myrup Pedersen

kmp@cabacapital.dk

On June 16, Jay Powell is going to talk a lot about base effects. While those are important, he might be missing the point that the US CPI impact arising from the corona shock could be lagging. As Bank of England has stated: “We reaffirm Friedman’s result that it takes over a year before monetary policy actions have their peak effect on inflation”. Imagine that the same goes for the “V-Shaped Corona Shock” last year, but that these initially deflationary pressures have been more than outweighed by the combined fiscal and monetary stimulus.

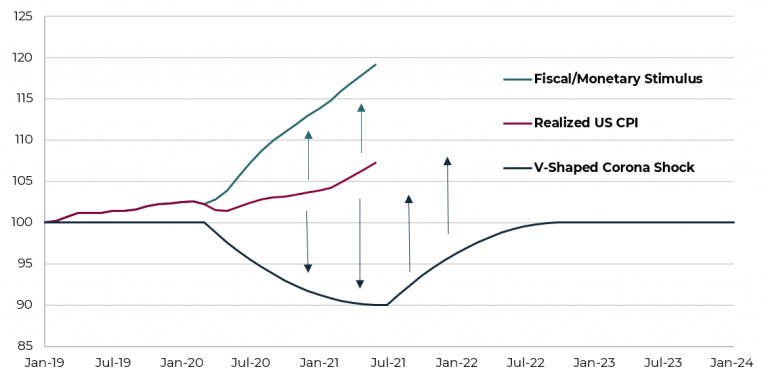

If this is the case, the deflationary pressure will only now begin to wear off and instead be reversed by the inflationary pressure arising from the right-hand-side of the “V”. Whether this is the case or not is of course an open question, but in CABA Capital we believe that there is a good probability that it is. We have illustrated this phenomenon – which we have coined “Shadow Base Effects” – in the chart below (based on our best guesstimates).

Guesstimated Decomposition of US CPI

Kilde: CABA Capital

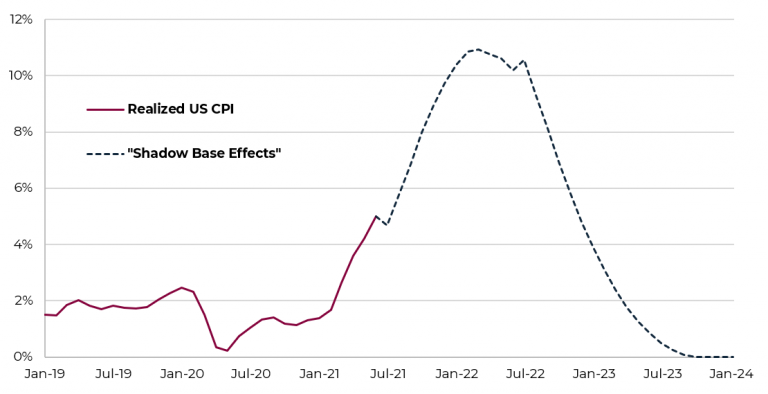

If this phenomenon turns out to be real, and if we move forward in time with an unchanged level of fiscal and monetary stimulus (even though this effect is probably also lagging, pulling in the same inflationary direction), these “Shadow Base Effects” have the potential to significantly boost US CPI in the years ahead. This is, all else equal, illustrated below.

Potential US CPI impact from "Shadow Base Effects"

Kilde: CABA Capital

Only time will tell what happens next, but we believe that the coming years will continue to show US CPI surprises to the upside and that “Shadow Base Effects” will be playing an essential role. Therefore, we think Powell should be more focused on this phenomenon and start adding a “Shadow” to the ordinary base effects that he relies so heavily upon.

Disclaimer: This is a marketing communication. Please refer to the Investor Disclosure Document for CABA Hedge KL and to the KIID before making any final investment decisions. The material is produced by Fondsmæglerselskabet CABA Capital A/S (“CABA Capital”) by the intend of orientation. The information herein does not constitute an offer to buy or sell any investment. CABA Capital and its affiliates do not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. All investments in securities involve risks, which include (among others) the risk of adverse or unanticipated market-, financial- or political developments and, in international transactions, currency risk. Due to such risks, the value of securities may appreciate as well as depreciate. Past performance does not predict future returns. Future performance is subject to taxation which depends on the personal situation of each investor, and which may change in the future. CABA Capital has taken reasonable care to ensure that the information contained herein is complete and correct; however, CABA Capital does not warrant this to be the case and accepts no liability for any errors, spelling mistakes or omissions.